Over 140 years of servingour clients and community.

We are a fifth-generation, Trusted Choice agency, serving New Jersey, Southern New York, and Eastern Pennsylvania.

Impeccable Service Spanning Across Five Generations

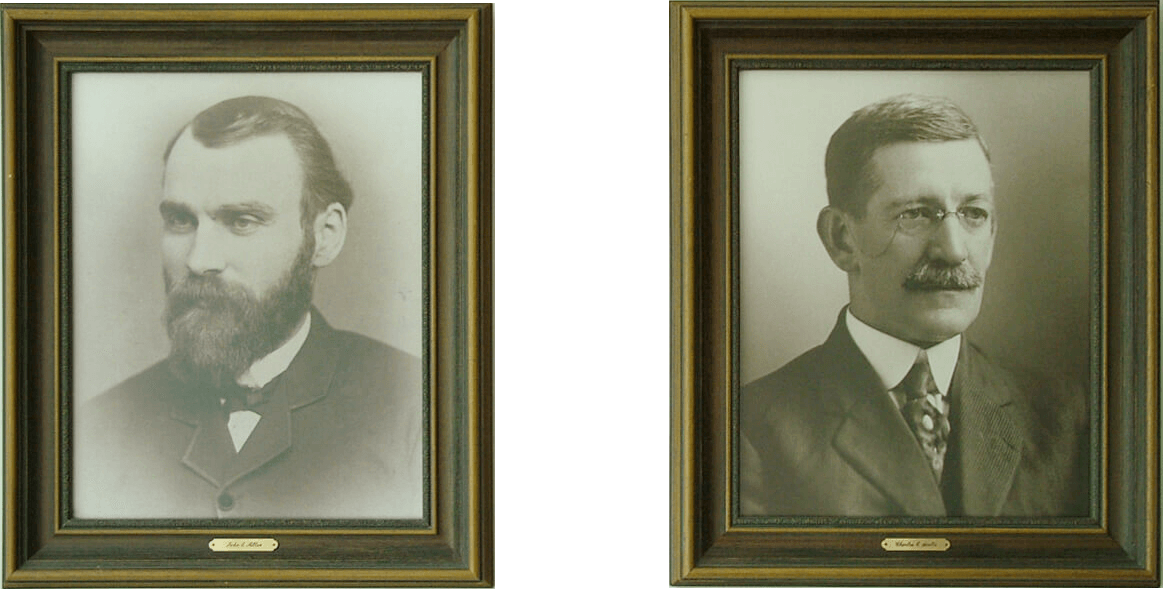

Allen & Stults Co., Inc. is a Trusted Choice independent insurance agency offering a comprehensive suite of insurance solutions. Established by John Allen & Charles Stults in Hightstown in 1881, the fifth generation of the Stults family currently operates the agency.

For over 140 years we have served families, businesses and non-profit organizations across New Jersey and surrounding areas. As we have grown, so have our deep connections with our community and clientele.

COVID-19 Updates

We’re proud to have stayed open every day throughout the COVID-19 pandemic, whether it has been working in the office or remotely.

For clients who need to visit our office, please call ahead (609-448-0110) and one of our staff members will be glad to meet you Monday through Friday, 8:30 – 5:00.

Insurance Specialties

Testimonials

“Since we are insurance producers we appreciate all the hard work that goes into making sure the customers and clients have the best possible coverage. Title Insurance has one major difference and that it is that we insure for what may have happened in the past. All other lines, insure for what might happen in the future. Thank you for protecting our future!”

“Thanks “Cappy” for all of the wonderful service and advice you have provided to the fraternity over these many years, Always professional and never too busy to assist in any way.”

“Over the years, many have solicited me for my insurance, both business and personal. Sometimes all I have to say to make them give up, is “I work with Allen and Stults.”

“The best move we ever made was in switching over our insurance to Allen & Stults. Increased and better coverage at a better rate. Also better service and professional advice.”

“Our Condo Community has had the sincere pleasure and is proud of having a long standing and mutually beneficial relationship with three generations of the founding family. Professionalism, customer service and knowledge is customary when dealing with Cappy and the many talented people associated with Allen and Stults.”

“I never realized that our Insurance Agent would care enough to drive out to our business and hold our hands at 2 am after the flood….and the same thing when we had the vandalism to the course. There are many other examples and thoughts to add and I know the Chief will want to contribute too. Not to mention all of the sage advice you have shared with us over the years. We are truly blessed to have you, Abi, Brent, Cathy, Bill and your entire staff take care of all of our needs. You are our guardian angels.”

“You and your entire organization exemplify all the best qualities of excellence in customer service and value.”

“You guys have, through your rep Cathy, been very dutiful in keeping me up to date and fully informed relative to my various policies with you; including our vehicle and condo unit. Thankfully, I have not had to call on you with a major cause but remain confident that you’ll be as supportive as needed. We’ve felt very comfortable for the past 16 years of living in Monroe.”

“We have had the pleasure of dealing with Allen & Stults Co., Inc. on various types of insurance as well as SEP and other such plans for more than 50 years. During that time we have had professional and personal attention by Cappy and members of his staff. But perhaps just as important, members of the firm have consistently provided advice and counsel that was accurate and timely. Any individuals who we have been referred to the firm have responded to us with positive feedback and thanks.”

“We have had our home and auto through your company for 9 years and have been very happy with the service and prompt responses from our representative Cathy Mazzolli.”

“It is a tribute to generations of professionalism and dedication to client’s business and personal needs. I know that is certainly the case since I switched to Allen & Stults.”

“Through the years, your service to our Society has been greatly appreciated. Our best wishes to you and all who are part of Allen & Stults Co. Inc.”

“We value our association with you and your staff and wish you many more years of success.”

“On behalf of our organization, I thank you for your excellent advice for insuring our lodges’ and members. Your generous assistance and patience with our issues are greatly appreciated.”

“I am a resident of East Windsor with a business in Allentown. My business is relatively new, and William Daly and Gerald Ford were very helpful in explaining insurance issues to me. They were both generous with their time and were patient with me as a new small business owner. Bill got me a great deal on life insurance, and I was really impressed with his knowledge of the new health care issues.”

“It has been such a pleasure to have your company handle my insurance for many years. Everyone does their job in a hugely professional way, and also with great pleasant, personal consideration. Not only have I had expert advice on the best insurers and the type of policies and coverage, but also have been offered kind and expert advice when a claim has been necessary. To say that I appreciate your company would be an understatement!”

“I have had the privilege of associating with Allen and Stults as both a customer and business associate. Both sides of the interaction have been great. Cathy Mazzoli does an excellent job of taking care of customer needs. I was the Regional Manager for a personal lines company and interacted with hundreds of Personal Lines Managers. Cathy is the most competent of them all. As a client I felt the professionalism, but as a business associate I could make comparisons to other agents, and Allen and Stults is at the top of the list.”

“Cathy has always been upbeat, personable and most important a true professional. She truly cares about all her clients.”

“Thanks to you, Cappy, and your professional staff, you have gotten our immediate family through two fires, a lightning strike, a car accident, a broken water pipe, and many insurance issues involving our business. Always there, whatever time, with your knowledge, experience, and most importantly, your compassion and empathy. While forging through red tape, paper work, and phone calls, your guidance has always been on target, with our best interest always being first. We cannot begin to thank you and your dedicated staff enough for that.”

“To suggest that Allen & Stults has had an influence on our lives would be a gross understatement. I’m not at all sure where we’d be or what we would be doing without the help and support of Allen & Stults and the Stults family over the years. We’ve bought our house insurance, automobile insurance, life insurance, umbrella policy…you name it…. from Allen and Stults because you helped us, guided us, stood by us, and advised us in all kinds of situations. Even here at Rossmoor our house insurance is handled by you folks. We have valued your business acumen over the years and also the friendship of you and your staff. We feel that our well being and all our insurance has always ” been in good hands”, to borrow a well known phrase.”

“It has been my distinct pleasure in working with you over these past years in meeting the insurance needs of our church. We count ourselves among your friends and loyal clients as we have always been met with prompt, courteous, efficient and friendly service. We rest secure in the honesty and integrity of Allen & Stults and its leadership.”

“Not only have I used you for my personal and Company insurance I have always been able to refer clients to you with the comfort of knowing they will receive professional & caring service. The attitude of the staff reflects the family pride of ownership.”

“Our company established its US presence in 1999, and was recommended by a friend to use A&S to take care of all our insurance requirements. Our association is 12 years old – and A&S has earned our trust all along the way.”

“With the fortitude and perseverance along with the agency’s hallmark culture of excellence in customer service, the firm’s leadership has effectively maintained the will, tenacity and intellect to survive and prosper. Simply you are a wonderful example of American business leadership and one which every insurance company needs to keep in mind for. While these companies may effectively underwrite risk, they never can replicate or replace the value added benefits that an independent agency like Allen & Stults provides to its clients.”

“We know that every business requires a good ambiance, good quality of work and good communication skills and camaraderie in order to attract customers who become loyal to your business. Your relentless work ethics and commitment to quality customer service have contributed to your success and the reason we continue to have such a wonderful business relationship.”

“Our facility has found Allen & Stults to be honest and straightforward in your business. You have demonstrated a high degree of loyalty and trustworthiness to your clients and have carried out your obligation with vigor and resolve. Your integrity and reputation is above reproach and you have always had our best interests at heart. Our membership is proud of you for all you have done for us. We highly recommend the services of Allen & Stults Co. to anyone.”

“I must admit, that as a business owner, it is sometimes shocking to find the level of unprofessional behavior that I constantly experience in the industry. It is for that reason that I must inform you of the simply OUTSTANDING service provided to my company by two of your professional Business Insurance Agents, Brent Rivenburgh and Gail Lanza. We needed a new policy that would meet the requirements specified in our office lease. They were able to quickly determine our needs and work with The Hartford to supply us with our new Certificates of Insurance in record time. This amount of professional respect they have for their clients and determination to go the extra mile are both welcome and appreciated. “

“In 1975 Allen and Stults became my Insurance provider, Landlord and Cappy Stults became my friend and colleague. I have valued each of these relationships over the years and have taken advantage of them. On a these occasions, I have always found the Allen and Stults staff knowledgeable, competent and ready to help without delay. They have always had my best interest in hand and have never disappointed me with their response to my need; often going beyond my initial request. I look forward to continuing that relationship for years to come.”

“We have relied upon Allen & Stults for many years not only for all of our insurance needs, but also for candid advice and good counsel. I have always known that you and your company would get back to us quickly, give us full information, detail the pros and cons, and ultimately provide us with solid recommendations for our insurance. This is a hallmark of a good business but you have done much more.”

“You have always considered and treated your clients as if they were family. You are an asset to your community. We wish you much continued success and are proud to be your clients and friends.”

“We have been pleased to have been a customer and had your help for over thirty years. Great advice and steady support.”

“Allen & Stults came to my rescue. Allen & Stults set up an installment plan for me. I would not have survived in business if it wasn’t for the help from Allen & Stults. I learned my lesson and never was surprised by an audit again. I have always tried to warn new contractors about the pitfalls of not being prepared for their insurance needs. I want to make sure that no other young company makes the same mistakes I made. Thank you Allen & Stults.”

Latest Articles

Tornado Hits While Driving

Seeing a tornado while driving can be terrifying. Being prepared and knowing what to do ahead of time can be the difference between life and death. Here are…

Winterizing Your Home in New Jersey

Winterizing your home is very important. It should be done not only to avoid claims, but also to decrease your power bills. An example of a claim is water…

Lost Your Health Insurance Because of a Job Loss? There Are Options

WE can help you review your Medical plan options and replace the health insurance plan that was provide by your former employer. Quality, affordable health…